The Board of any size of organisation needs to be on the front foot in respect of how risks are managed, enterprise-wide. The expectations of both internal and external stakeholders, including regulators are now very high. Against this background, IRM Advisory can help Boards to sense check where they are now and how they need to improve their risk oversight going forward.

Boards - taking the lead on risk

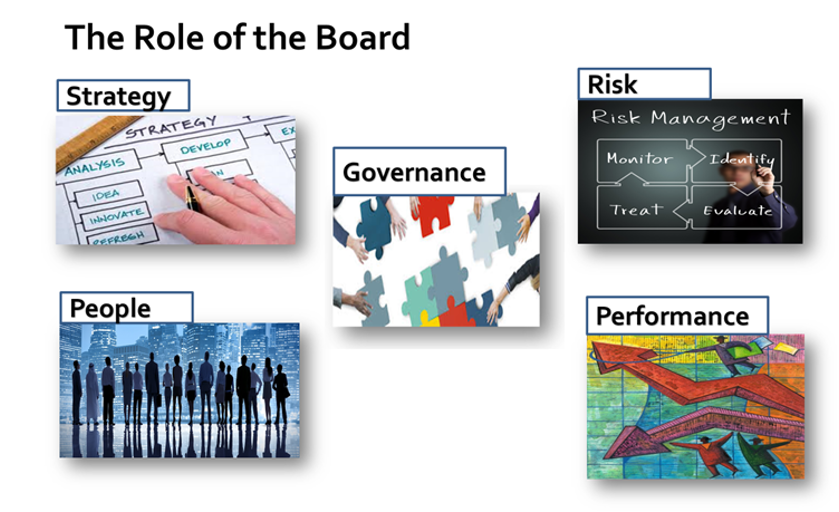

The Board’s role centres on five focus areas, with governance and effective risk management at the core. It is responsible for defining acceptable risk levels for strategic goals and maintaining strong risk management and control systems, as highlighted in the 2024 UK Corporate Governance Code.

Boardroom accountability

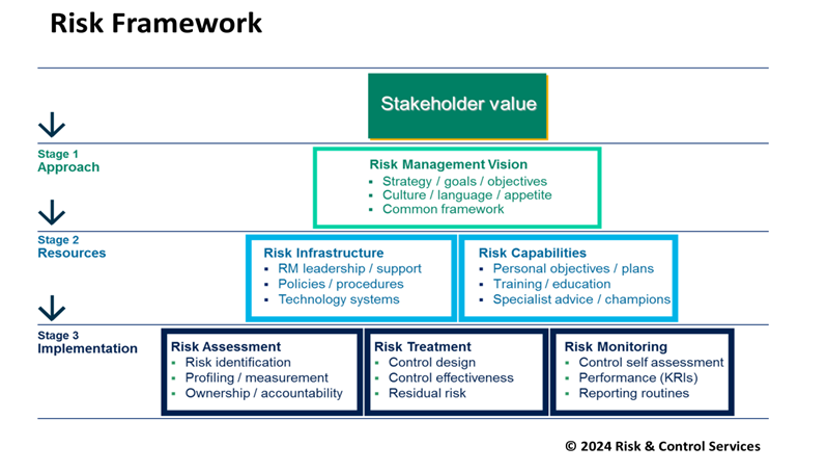

Board oversight of risk involves setting strategic risk parameters, fostering an organisation-wide risk perspective, promoting control, ensuring monitoring routines, and fulfilling reporting requirements. Effective risk management requires alignment between top-down (strategic) and bottom-up (operational) approaches, supported by clear structures and reporting lines.

Boards - taking the lead on risk

The Board’s role centres on five focus areas, with governance and effective risk management at the core. It is responsible for defining acceptable risk levels for strategic goals and maintaining strong risk management and control systems, as highlighted in the 2024 UK Corporate Governance Code.

Boardroom accountability

Board oversight of risk involves setting strategic risk parameters, fostering an organisation-wide risk perspective, promoting control, ensuring monitoring routines, and fulfilling reporting requirements. Effective risk management requires alignment between top-down (strategic) and bottom-up (operational) approaches, supported by clear structures and reporting lines.